estate tax exemption 2021 sunset

The District of Columbia moved in the. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

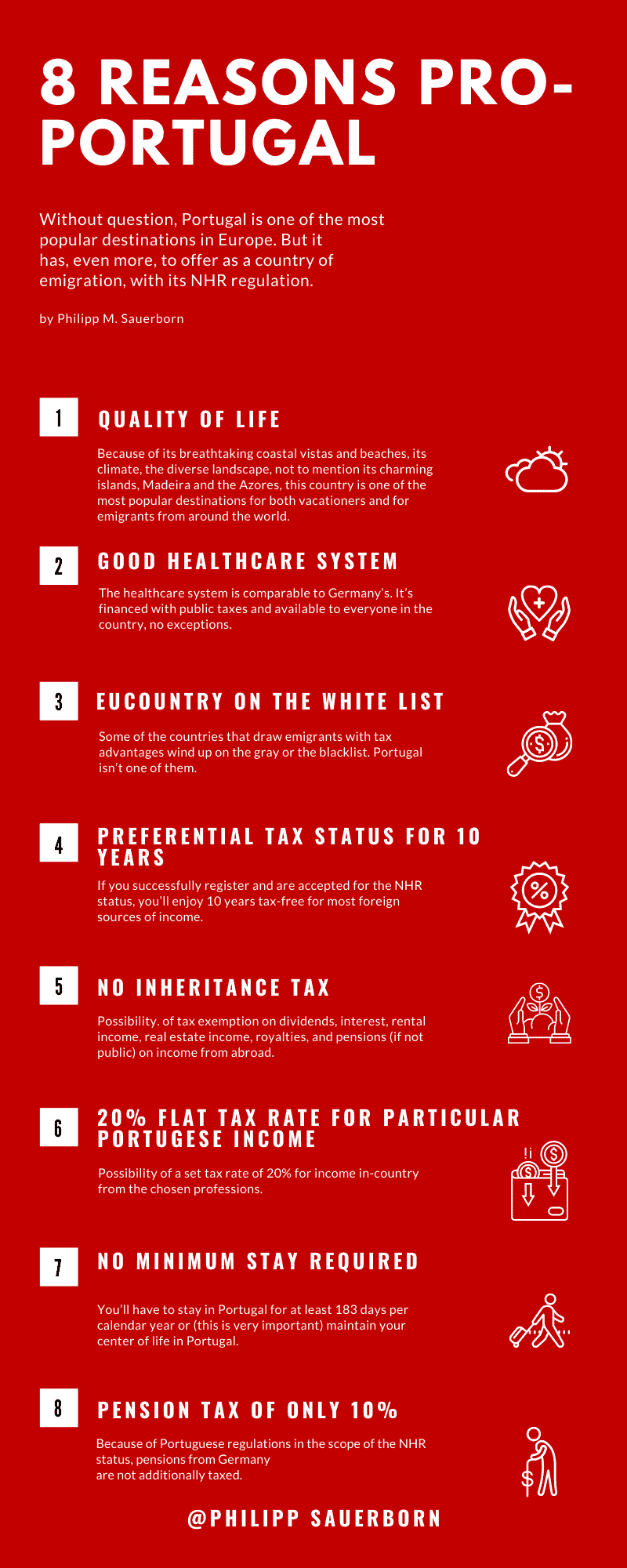

Complete Guide 2022 Emigrating To Portugal The Nhr Scheme

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

. Under the tax reform law the increase is only temporary. Phils 1158 million estate tax exemption was unused and Dora cannot claim the exemption without portability so Dora can only use her exemption of 1158 million when she passes away. How did the tax reform law change gift and estate taxes.

On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. 31 2025 and will return to the Obama exemption of 5 million adjusted for inflation. Things to know before estate tax laws sunset in 2025.

For couples the exemption is 228 million. Thats why December 31 2025 will be an important day with 23 provisions scheduled to sunset. This means that when someone dies and.

The maximum gift and estate tax rate is. Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022. Many however werent permanent.

The exemption was 55 million prior. After 2025 the TCJA is set to sunset and the exemption reverts to pre-2018 levels adjusted for inflation for an estimated future exemption amount of 68M. Things to know before estate tax laws sunset in 2025.

Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025. The tax rate applicable to transfers above the exemption is currently 40. The tax reform law doubled the BEA for tax-years 2018 through 2025.

This higher exemption amount has continued to increase indexed for inflation and the exemption in 2021 is 117M. The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and Jobs Act of 2017. The base amount currently is 10000000 set in 2017.

However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 117 million for 2021 and 1206 million in 2022. Families will have to seek to amend and adjust their estate planning prior to the end of 2021 in anticipation of the tax law changes in 2022. Additionally the upcoming US.

Thus the estate tax rate is 40 and Doras estate is still worth 20 million. Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021. Significant provisions scheduled to expire.

The current exemption will sunset on Dec. On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than half the current tax-free gift limit when you die. The real estate assessment exemption process is.

The gifting frenzy has continued through 2021 as more people have grown concerned that the 11 million exemption would drop sooner than 2026 and possibly lower than 5 million given the. The 2017 Trump Tax Cuts also increased the lifetime Gift Tax Exemption to as of 2021 117 million. Many however werent permanent.

On January 1 2018 the Tax Cuts and Jobs Act TCJA added provisions to the tax code to reduce income tax burdens. If you are a senior citizen or disabled you may qualify for a partial real estate assessment exemption. If your estate is in the ballpark of the estate tax limits and you want to leave the maximum amount to your heirs youll want to do some estate tax planning.

Yahoo Finances recent article IRS Says Millionaires Can Keep Estate Tax Benefits After 2025 says that the exemption increase was a big priority for Republicans in the 2017 tax overhaul. This exemption decreased the number of individuals whod be subject to the 40 estate tax by about two-thirds. Current Law in 2021 The current estate gift and generation-skipping transfer GST tax exemption is 117 million per person with a top tax rate of 40 which is set to sunset at the end of 2025 to pre-2018 levels to approximately 6 million 56 million adjusted for inflation.

The adjusted exemption in 2026 is projected to be between 6 million and 7 million. Take Advantage of Exemptions Now. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available. There are certain age and income requirements that you must meet to qualify. Thats why December 31 2025 will be an important day with 23 provisions scheduled to sunset.

Letss assume the estate tax exemption is still 114 million when Dora dies. Said another way you should keep reading if your estate value exceeds 11580000 5790000 if unmarried. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018.

Therefore a person can gift 117 million over the course of their lifetime. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. On January 1 2018 the Tax Cuts and Jobs Act TCJA added provisions to the tax code to reduce income tax burdens.

The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. The Build Back Better bill thats been bouncing around in Congress included a provision that would accelerate the sunset provision so that the exemption would drop to the 6 million figure as of Jan. The City of Newarks 2021-2022 property tax rate is 09348 per 100 of assessed value.

This temporary exemption is set to sunset in 2025 and would revert to the previous limit likely around 58 million when adjusted for inflation. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. What was considered a tax-free gift on December 31 2021 now becomes a taxable gift and incurs gift tax of 2565000.

Taxpayers who are considering substantial gifts or similar planning today. What is the transfer tax exemption for 2022. Significant provisions scheduled to expire.

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

U S Estate Tax For Canadians Manulife Investment Management

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Corporate Tax In Germany A Guide For Expats Expatica

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

German S Fuel Emissions Trading Act Behg Is Boosting Biomethane Demand Biogenerated Energy Matter

Do I Pay Tax At My Death Hawaii Trust Estate Counsel

Germany European Court Of Justice Rules On The Cross Border Provision Of Company Cars Bdo

Good Practice In Tax Management And Strategy Nestle Global

Three Estate Planning Strategies For 2021 Putnam Investments

Usa Today Estate Tax Filing Taxes Irs Taxes

Corporate Tax In Germany A Guide For Expats Expatica

Hungary Most Important Changes To Online Invoice Reporting

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

What Happened To The Expected Year End Estate Tax Changes

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats